Ordinary Rate of Pay Malaysia

Section 60F3 of the Employment Act 1955 states The employer shall pay the employee his ordinary rate of pay for every day of such sick leave and an employee on a monthly rate of pay shall be deemed to have received his sick leave pay if he receives from his employer his monthly wages without abatement in respect of the days on. Digital Service Tax in Malaysia.

Your Step By Step Correct Guide To Calculating Overtime Pay

Number of hours in excess of 8 hours 125 x hourly rate On a Rest Day or Special Day.

. In the case of an employee employed on piece rates who works on a rest day shall be paid 2 times the ordinary rate per piece. Additionally Section 60D 3b. Different rights can be attached to different classes and types of shares for various purposes such as.

Capital Gains Reduction Report The best way to determine what expenses investors can add to their cost base and how they can reduce the amount of capital gains they declare would be to have a quantity surveyor draw up a Capital Gains. Every employee shall be entitled to 11 paid holidays at his ordinary rate of pay on the following days in any 1 calendar year 5 of which shall be. RM100000 per annum Annual fee.

020 base rate 020 bonus rate. Based on exchange rate. For example an employee who works 8 hours a day for a monthly salary of RM260000.

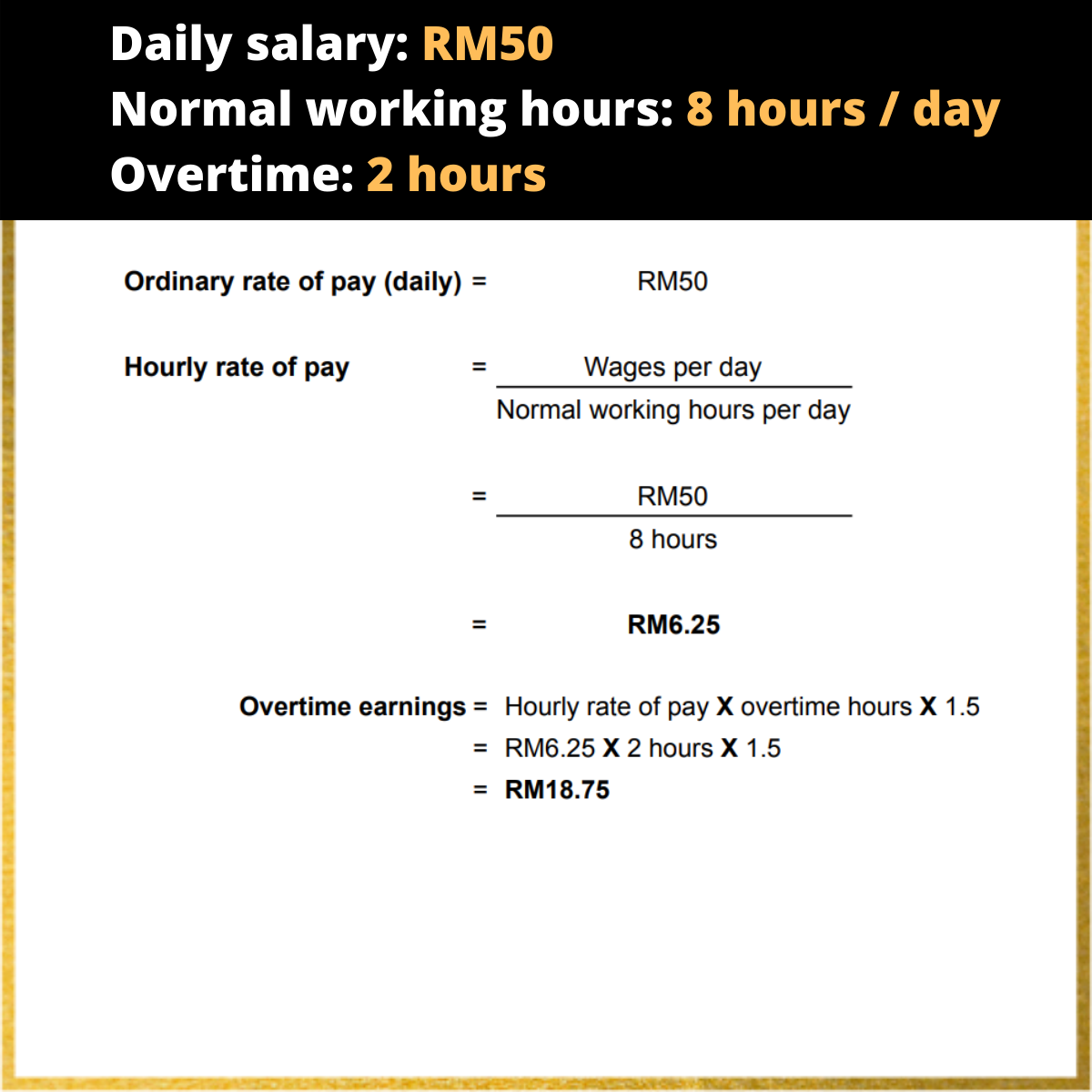

Click the draft pay run to open it. Fees for Foundation in Science is RM24900. The same employees hourly rate of pay would be RM1250 RM100 8 hours RM1250---.

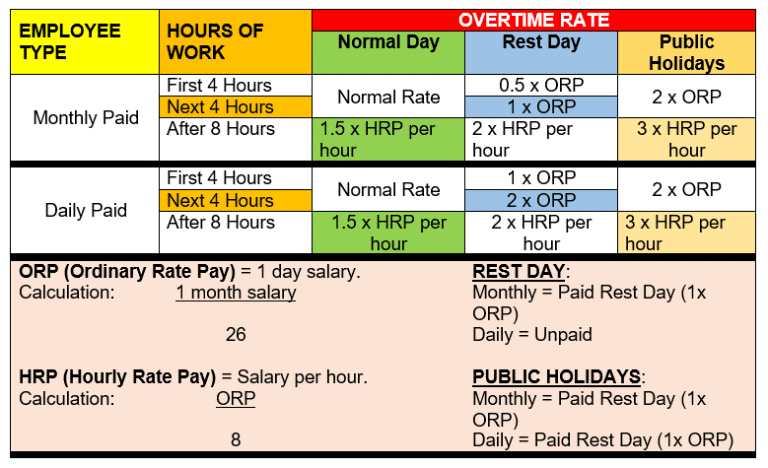

Ordinary Rate of Pay OPR OPR means wages whether calculated by the month the week the day the hour or by piece rate or otherwise which an employee is entitled to receive for the normal hours of work for one day. 60 of the Employment Act an employee may be required to work on any paid holiday subjected to two days wages at the ordinary rate of pay. 2nd class Petty officer.

RM1800 RM26 RM6923. The employees stay in Denmark may be longer. 60 of Malaysia Employment Act 1955.

A Regular Holiday which is also a scheduled Rest Day 260 x basic daily rate Computing Night Shift. A manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Click Reset Payslip to bring through the new salary and wage. Under Earnings Rate update the employees salary pay rate or ordinary hours. Heshe will have an ordinary rate of pay of RM100 RM2600 26 RM100.

Apply updated salary and wages or hours to a draft pay run. In the Payroll menu select Pay employees. Any payment made under an approved incentive payment scheme or.

05 x ordinary rate of pay half-days pay ii. A ordinary shares and B ordinary shares or different types of shares eg. Rank group Senior NCOs Junior NCOs Enlisted 1901 1913 No insignia.

1st class Petty officer. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii. To do this divide the monthly salary by 26 days.

Maybank 2 Cards Premier Best Conversion Rate. However after the 84-month period the employees income is taxed at ordinary rates. Companies may issue different classes of the same type of shares eg.

RM1 per 1 Enrich Mile for all local and overseas spend on American Express Other air miles claimable. Capital gains taxes on assets held for a. Name the pay item and complete the other details as needed.

A1 RM30290 NZ1 RM27990 1 RM54320 It is compulsory to complete the one-year IMU Foundation in Science prior to embarking on this pathway. Ordinary shares or preference shares. Then take the daily rate and divide that figure by the number of hours to get the employees hourly rate.

For instance you will get a total rate of 030 pa. In the Payroll menu select Pay employees. RM6923 8 hours RM865.

3 years Minimum income requirement. However with the nation under various forms of lockdown and movement control orders since 2020 due to the COVID-19 pandemic many workers have opted against using their. Add the custom pay item to the employees payslip in the pay run period the public holiday falls in.

Overtime Rate according to Malaysian Employment Act 1955. RM800 free for the first year and with minimum spend of RM80000 per year subsequently. Ordinary Day 110 x basic hourly rate Rest Day and Special Day 143 x hourly rate Regular Holiday 220 x hourly rate Computing Overtime.

As the labour market tax also applies the combined tax rate is 3284 each year during the 84-month period. 020 base rate 010 bonus rate for the first month and if you are able to increase your balance by another RM500 in the second month then your total interest rate will be increased to 040 pa. Work force hire scheme.

The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. In excess of eight 8 hours-15 x hourly rate x number of hours in excess of 8 hours. This could lead to a reduction in the amount of CGT required to pay on the sale of the investment property.

Click on the pay run for the period that includes the public holiday. In Malaysia there are two types of public holidays. How to calculate Ordinary Rate of Pay and Hourly Rate of Pay.

Still most employment contracts in Malaysia provide for annual leave entitlements usually ranging from 14 days a year all the way up to 20 or even 30 days of annual leave. Tuition and ancillary fees at partner universities overseas are subject to annual increases. KrisFlyer Asia Mile Reward points validity.

Ways To Pay For Sales And Services Tax SST In Malaysia. 0 Buy Now Pay Later Buy anything now pay later with 0 instalment plan over 3 months on Smart credit card. Add the pay item to an employee.

Junior rate Royal Navy 19131953. To calculate the employees ordinary hourly rate of pay youll first need to calculate their ordinary rate of pay daily. The Good Life Privileges.

No deductions are allowed against the flat rate taxed income. Click the employees name to open their payslip.

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

0 Response to "Ordinary Rate of Pay Malaysia"

Post a Comment